Fitch’s neutral outlook for major insurance markets in APAC – China, Japan, and Korea – reflects the expectations that the performance of these sectors will stay stable in 2024, despite the macro challenges.

China Insurance Outlook 2024: Earnings Hinge on Investment Returns while Regulatory Initiatives to Underpin Capitalisation and Growth

Fitch’s Life Sector Outlook: Neutral

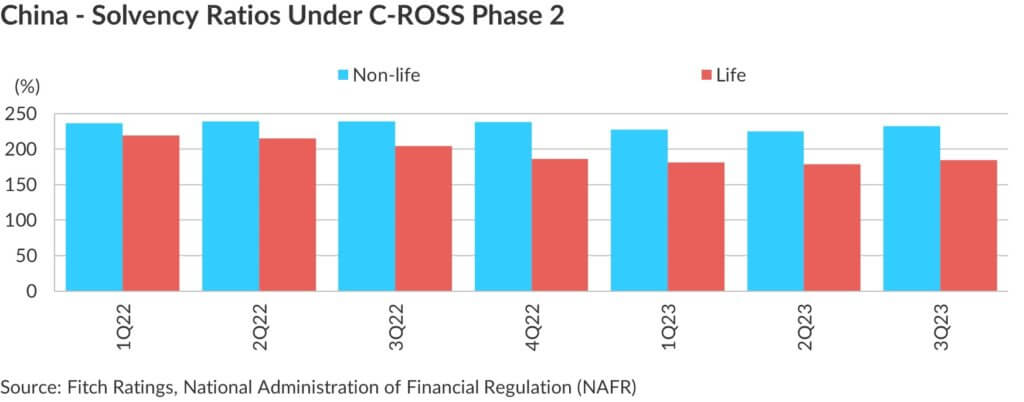

Fitch Ratings’ neutral outlook for the Chinese life insurance sector in 2024 is underpinned by moderate industry premium growth, improving underlying business margins on financial regulator National Administration of Financial Regulation’s (NAFR) push for lower commission expense, and capital relief under recent updates to the China Risk-Oriented Solvency System (C-ROSS) phase 2 that took effect on 1 January 2022. The sector outlook also takes into consideration the risks of a spillover in China’s property slump that could lead to a tightening in financial conditions in 2024.

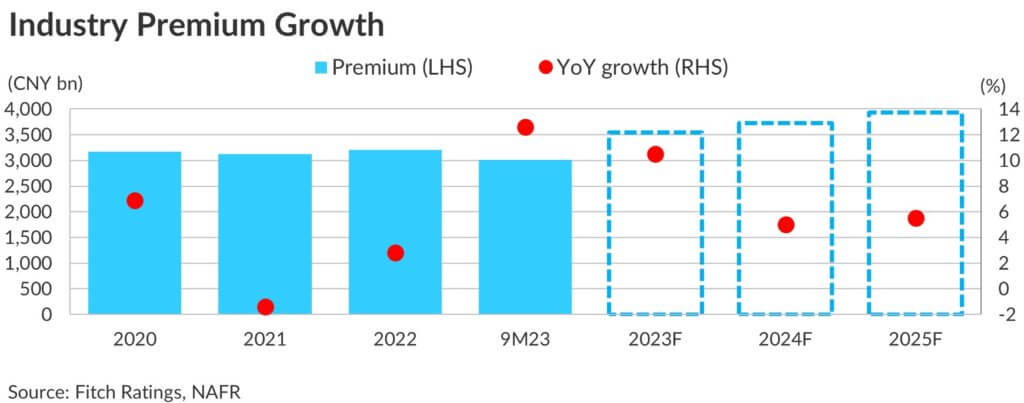

Savings products will continue as the premium growth driver in 2024, reflecting customer demand and market sentiment. Health insurance growth will remain relatively flat on a reduction in the number of agents and unfavourable claims, although the Chinese government has announced policies to promote commercial long-term health insurance and wider insurance coverage.

Fitch expects the life insurance industry to have steady and better-quality growth in 2024. The release of regulatory notices to life insurers and revamped solvency regulation support the healthy development of life insurance, although challenges remain.

Fitch’s Non-Life Sector Outlook: Neutral

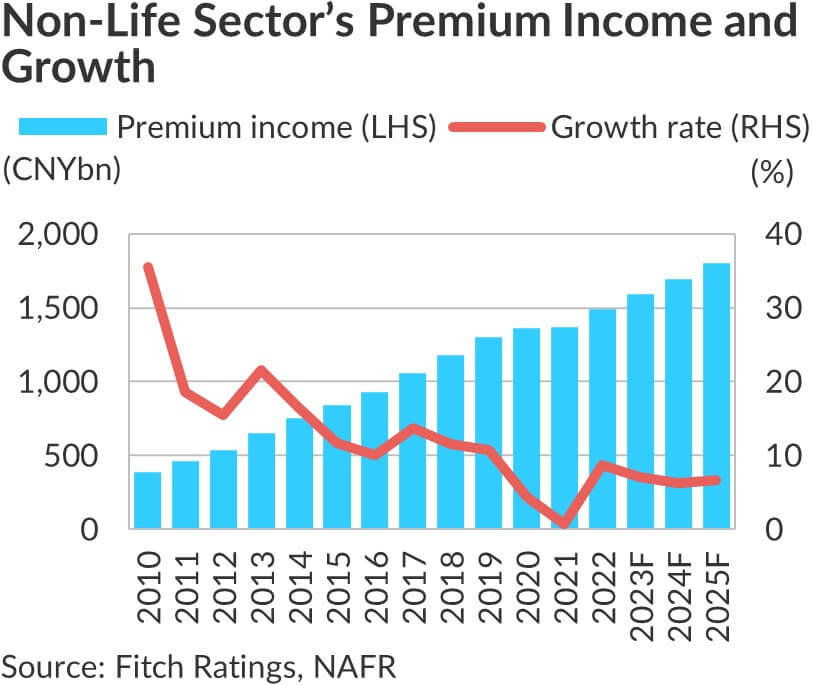

Fitch Ratings’ sector outlook reflects our expectation that China’s non-life insurers will maintain a sound solvency buffer and financial flexibility to support the stable pace of premium expansion in 2024. Solvency adequacy is reinforced as a result of the revision of several rules in the calculation of the minimum capital requirement of insurers solvency in September 2023. Capital infusion, however, is inevitable if insurers’ business expansion continues to outpace their surplus growth.

We do not anticipate the pace of premium growth to accelerate in 2024, while insurers will continue to optimise their product mix by expanding non-motor insurance – due to ongoing demand for regulatory-initiated products. Government’s measures on promoting automobile consumption will support insurers’ motor premium generation.

The motor insurance margin is unlikely to decline significantly despite further relaxation of commercial motor premium pricing limits in 2023. We expect greater pricing flexibility will provide motor insurers with an incentive to reinforce their underwriting sophistication. Underwriting deficits of insurers with smaller scale will persist, while scale advantage will enable large firms to sustain their margin. Claims from catastrophe perils will remain a threat to operating stability.

Chinese Life Insurers: Industry Premium Growth

Chinese Non-Life Insurer: Industry Premium Growth

Japan Insurance Outlook 2024: Fundamentals to Remain Overall Healthy

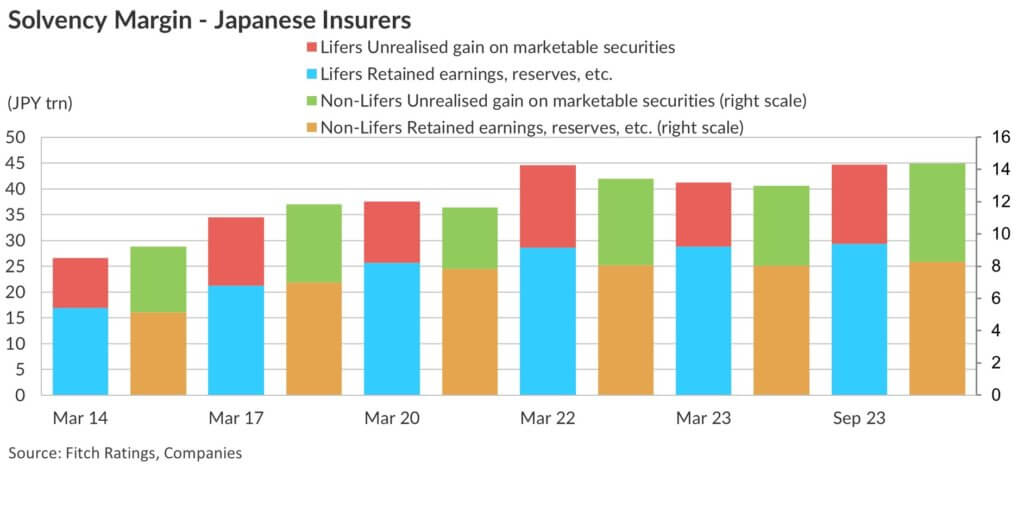

Fitch believes underwriting profits will continue to recover in 2024, as insured losses arising from Covid-19 have subsided. We view the biggest risk for Japanese insurers remains the volatility in financial markets, while moderately rising Japanese yen bond yields and the yen’s depreciation work in their favour.

Fitch’s Life Sector Outlook: Neutral

Fitch Ratings believes Japanese life insurers’ earnings will be stable in 2024, even after considering the negative impact from volatile global financial markets, and they will maintain capitalisation at healthy levels in the near future.

Investment spread has become a larger portion of total earnings than before, at approximately 50%, due mainly to secular growth of positive investment spread and continued declines in average guaranteed yield. Earnings from profitable protection-type insurance underwriting (such as health insurance and death protection), which are quite stable and much more profitable than in most jurisdictions outside Japan, still represent the major part of the total earnings.

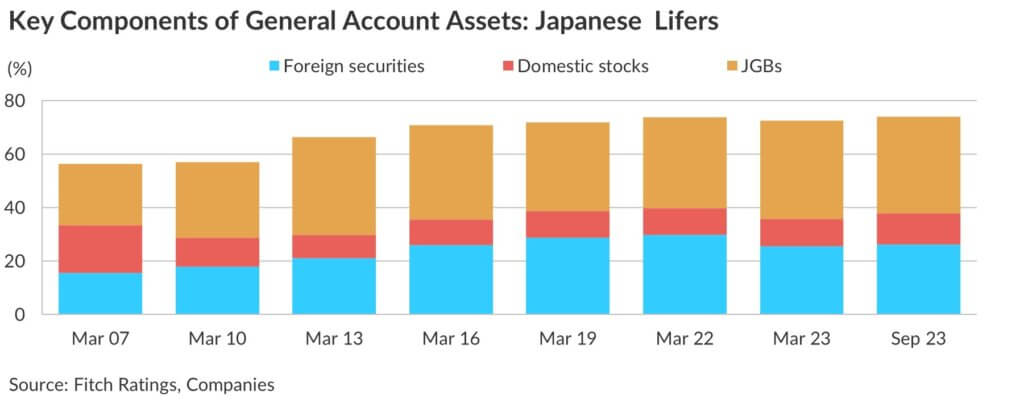

Fitch expects Japanese insurers to continue to expand overseas, driven by a saturated domestic market – especially for life insurance – caused by an ageing population and shrinking workforce. The country’s four major life insurance groups and three major non-life groups are likely to continue to acquire insurers in the countries such as the US, the UK and Australia.

Fitch’s Non-Life Sector Outlook: Neutral

Fitch believes Japanese non-life insurers’ pricing of premium rates will continue to be favourable. Premium rates for property insurance are likely to continue to rise to cope with insured losses from catastrophes, which will boost insurers’ results over the medium term. Fitch expects Japanese non-life insurers to maintain strong capital adequacy, backed by accumulated core capital, including retained earnings and capital reserves.

Japan remains at substantial risk of natural catastrophe events, which leads us to expect non-life insurers to continue to raise premium rates for domestic non-life products, as they face higher reinsurance premium rates. Given the high reinsurance premium rates recently, Japanese non-life insurers have raised their risk retention compared with a few years ago. Thus, their insured losses might be substantial if significant natural catastrophes hit Japan in 2024.

Korea Insurance Outlook 2024: Contractual Service Margin a Key Value Driver

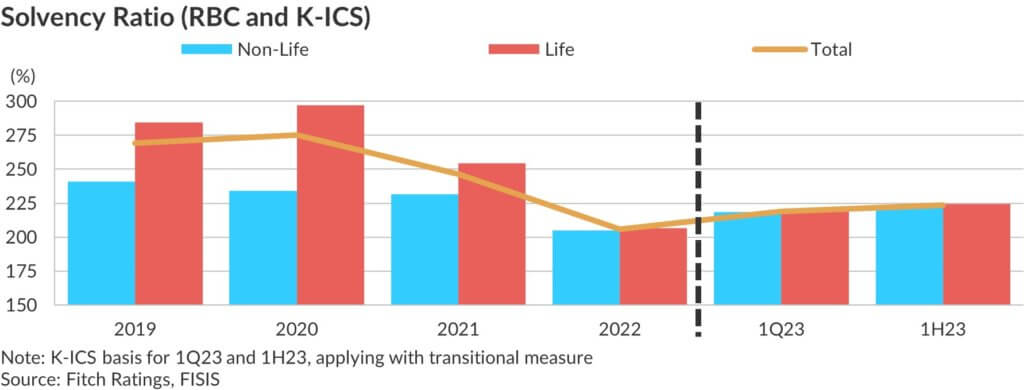

Fitch expects a stable overall performance for Korean insurers, driven by higher investment returns, a narrowing in negative spreads, and contractual service margin (CSM) recognition, despite persisting uncertainty over the operating environment. We see insurers under IFRS17 and K-ICS as likely to reshape the operational strategy during the transition phase, and the results should improve gradually from 2024.

Fitch’s Life & Non-life Sector Outlook: Neutral

Fitch Ratings expects the performance of Korean life and non-life insurers in 2024 to be stable amid a high-interest-rate environment – due mainly to higher investment returns, a lower burden on negative spreads, and amortised CSM recognition. Insurers are still facing uncertainty over the operating environment, with prolonged inflation and high interest rates.

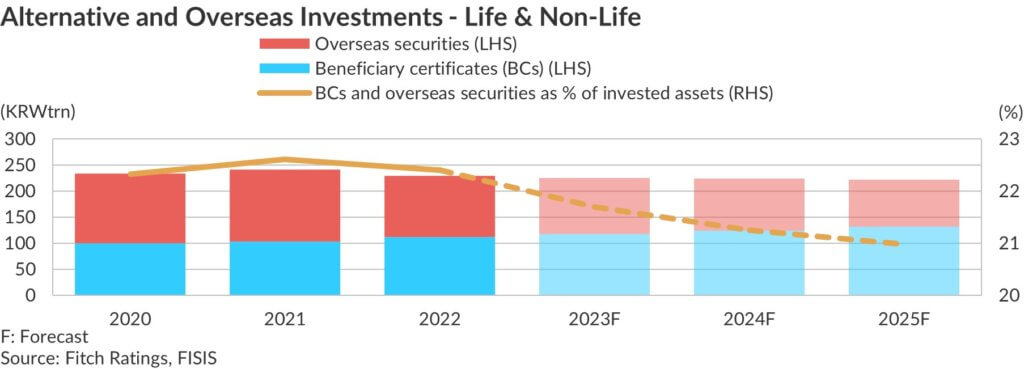

However, we believe insurers will optimise their insurance and investment portfolios, focusing on new business with high CSM – such as protection and health-type products – as well as investing more in longer-term and stable yield generation assets, with lower risk charges to reduce the capital burden.

Both lifers and non-lifers reported strong net profits in 1H23, up by 64.7% and 54%, respectively. This was led mainly by accounting standard changes with sound CSM amortisation, despite direct comparability between IFRS4 and IFRS17 being still limited. Non-lifers are maintaining a decent underwriting performance, as major companies’ combined ratio for property & casualty and motor business is consistently below 100% under IFRS17. We also expect total assets and profitability to grow smoothly, led mainly by sound CSM growth.

Nonetheless, uncertainties still persist, with higher claims reflecting higher claims payouts and an increase in reinsurance costs. In addition, insurers’ ‘fair value through profit and loss assets’ (FVPL) has risen considerably after the reclassification of investment assets under IFRS9, which could lead to an increase in the volatility of insurers’ investment returns. Insurers will place greater effort in switching the assets from FVPL to ‘fair value through other comprehensive income’, in an attempt to reduce potential volatility in profitability.

Learn more about Fitch’s views, visit: www.fitchratings.com/insurance

or contact us:

|

Jeffrey Liew

Senior Director, Head of Insurance Ratings, APAC Email: [email protected] |

|

Mee Ryung Song

Senior Director, Business Relationship Management, APAC Email: [email protected] |

-

HSBC Asset Management | The hunt for diversification and performance revitalizes appetite for Asian currency bonds

With diversification and performance high on investors’ agendas, it seems a good time for global portfolios to revive allocations in Asian local currency bonds – including Hong Kong dollar (HKD) bonds.

-

PineBridge Investments | Why Asian insurers are exploring private credit and CLOs

The recent rollout of risk-based capital regimes across Asia calls for a closer alignment between insurers’ assets and liabilities. We explore potential ways to maintain a healthy investment yield and robust returns on regulatory capital.

-

Peak Re | Emerging Asia middle class: A catalyst for change

Rising demand for elderly care and women driving consumption growth mandate carriers to develop precise solutions to meet customer expectations.

-

Guy Carpenter | Private equity’s reshaping of the Asian life sector has further to run

PE-backed reinsurers provide access to asset classes and investment expertise that often don’t exist within the traditional carriers themselves.