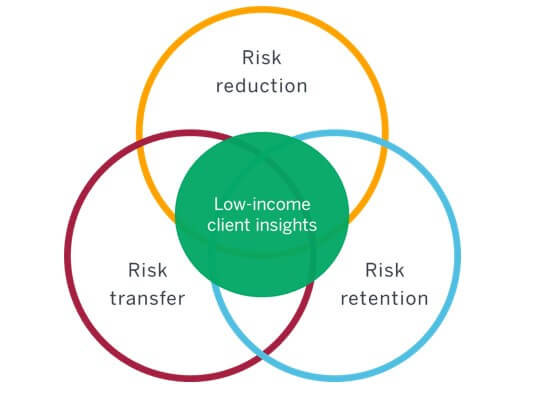

At the MicroInsurance Centre at Milliman (MIC@M), we believe insurance is one component of a broader risk management approach that is necessary for low-income populations to successfully manage their financial risks. We call our approach Risk Management 360 (RM360). This approach to individual-level risk management provides a holistic solution to risks faced by low-income customers. In practice, RM360 requires that a broad lens be used to explore potential solutions (financial and non-financial) to design a risk management blanket that helps low-income customers reduce risk (through prevention, preparation and adaptation) while preparing them to better retain risk (through financial and non-financial means) and transfer risk (through insurance) as the last recourse.

While insurance is core to managing risks, we recognise that our low-income customers, like the rest of us, would rather avoid a risk event from happening in the first place (e.g., a cow dying or a daughter contracting dengue fever) than just relying on a good insurance cover to pay after the event. Insurers also benefit from this approach because fewer risk events mean fewer claims. This, in turn, could translate into further benefits for customers in the form of lower premiums—that’s a win-win situation. Let’s look at an example of a livestock insurance cover, which in its basic form would offer the dairy farmer a fixed amount of money if her cow died. While that’s great, the farmer would prefer her cow staying alive and healthy over receiving a limited sum of money. If an insurer wanted to design a solution based on the RM360 approach, they could offer the insurance product (risk transfer) along with a “Call-a-vet” service (risk reduction) to offer immediate medical assistance in case of emergencies and/or better feed (risk reduction) to keep the cows healthy and provide more milk. They could also offer an emergency loan service (risk retention) to help in exigencies. This holistic approach would help and encourage the farmer to keep her cows healthy and get immediate medical help, which would reduce incidence of deaths. This, in turn, would be beneficial to both the dairy farmer and the insurance company.

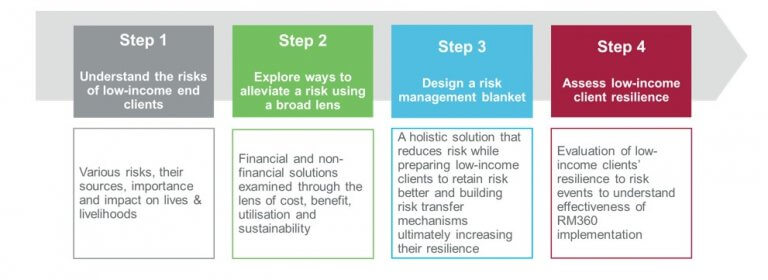

The first step of putting RM360 into practice is to understand the needs of customers, the risks they face, the impact on their lives of these risk events, the coping mechanisms they employ and their experience and perceptions of the effectiveness and additional burdens resulting from those efforts, including from insurance. Nothing can replace talking to customers and yet so few solutions are designed taking into account comprehensive client insights.

The second step in applying an RM360 framework would be to explore a wide variety of solutions, financial and non-financial, to alleviate the risk faced by a client. Thinking broadly and outside of financial solutions alone is critical at this stage because the client may not be aware or interested in the fact that an insurer can or will provide an effective formal risk transfer solution, for example. She is looking for the best possible solution or bouquet of solutions that meet her family’s needs. She will examine the various solutions by asking:

- Can I afford this?

- Is it worth my money?

- Will we actually use it?

- Will it sustain or benefit us in the long run?

- Do I trust it?

The third step, based again on client feedback, would be to design a risk management blanket, consisting of the financial and non-financial solutions that the client found valuable based on the above five criteria. A holistic solution is one that helps the client reduce her family’s risk while preparing her to better retain risk and build risk transfer mechanisms, ultimately increasing resilience to risk events.

The last step of the RM360 framework is to evaluate the effectiveness of solutions implemented in order to understand their long-term impact on low-income clients, i.e., did they contribute to making them resilient to the risk events they were tailored for?

Let’s see examples of insurers applying the RM360 framework. When the incidence of dengue increased drastically in the Philippines some years ago, Pioneer Insurance Company saw a need to cover their clients against the disease, which often led to long periods of hospitalisation and absence from work. Based on client insights, they designed a SUAVE[1] product that covered dengue fever and had a very easy claims process. The customer needed only to send their medical certificate and lab results on Viber or WhatsApp and their claim would be paid. In order to make the intangible offering more relevant to their clients, they partnered with a skin care company and offered a can of mosquito repellent with every dengue insurance policy. Conversely, customers who bought at least four mosquito repellent spray bottles from the skin care company received a free dengue insurance cover. The mosquito repellent reduced the risk of contracting dengue and the insurance cover was a back-up in case prevention did not work.

Another notable RM360 example is the Nibedita product from Green Delta Insurance in Bangladesh. What makes Nibedita unique is that besides coverage against accidents, the product provides a trauma allowance in case of rape, road bullying incidents, robbery and acid attacks. Additionally, women with Nibedita policy can also avail themselves of various services in the field of health, legal service, capacity building, lifestyle, counselling, financial service, travel service, etc. The main idea behind Nibedita is that women’s empowerment is a prerequisite for socioeconomic development of a country. Bangladesh, a lower middle-income country with a consistently growing economy, has seen a sharp rise in women participating in all spheres of public life. As a result, issues such as gender equality and women’s empowerment, amongst others, are widely discussed. This was the driver behind Nibedita’s aim to cater to the needs of women and to make them more independent and able to manage the unique risks that they and their families face.

This article was written by Indira Gopalakrishna, a microinsurance specialist, Asia Pacific at Milliman.

Watch the upcoming three-part vodcast series ‘360 Degree Perspectives’ on InsuranceAsia News, where Michael J. McCord, principal and managing director of the MicroInsurance Centre at Milliman, will be speaking about RM360 in practise and sharing thoughts with Bert Opdebeeck, the founder of the Microinsurance Master, Lorenzo Chan, president and CEO of Pioneer Life and the Retail Organization & Digital Transformation Head of the Pioneer Group, and Farzanah Chowdhury, managing director and CEO of Green Delta Insurance.

[1]SUAVE stands for Simple, Understood, Accessible, Valuable and Efficient. It is a concept of the MicroInsurance Centre at Milliman.

-

IFRS 17: Making your financial controls automation truly work for you

- September 26

Shifting towards a more automated and streamlined workstream can free up time for insurers to critically analyse results that inform future financial planning.

-

Flood resilience: Water, water everywhere…

- September 11

Floods are one of the most complex natural perils with highly localised impacts, making them challenging to insure and data is key to the effective design of an affordable product to protect the vulnerable.

-

Maritime energy transition: Data dialogue key to achieving decarbonisation goals

- August 3

Collaboration and shared learning amongst stakeholders will be vital to getting full value from the data captured as well as in achieving regulatory goals. The International Maritime Organisation’s (IMO) greenhouse gas (GHG) strategy is to reach net-zero emissions from international shipping by or around 2050, and there are various checkpoints to meet along the way. […]

-

Contentious losses: Evidence-led forensic investigations stand the test of time

- May 17

Even minor cracks in evidence capture will become exposed when it comes to recovery and repudiation. Forensic investigations form part and parcel of many insurance claims in the Asia-Pac region. Whether a loss is complex, costly, or if there are expected to be questions down the line around causation and liability, insurers and their loss […]

-

HSBC Asset Management | The hunt for diversification and performance revitalizes appetite for Asian currency bonds

With diversification and performance high on investors’ agendas, it seems a good time for global portfolios to revive allocations in Asian local currency bonds – including Hong Kong dollar (HKD) bonds.

-

PineBridge Investments | Why Asian insurers are exploring private credit and CLOs

The recent rollout of risk-based capital regimes across Asia calls for a closer alignment between insurers’ assets and liabilities. We explore potential ways to maintain a healthy investment yield and robust returns on regulatory capital.

-

Peak Re | Emerging Asia middle class: A catalyst for change

Rising demand for elderly care and women driving consumption growth mandate carriers to develop precise solutions to meet customer expectations.

-

Guy Carpenter | Private equity’s reshaping of the Asian life sector has further to run

PE-backed reinsurers provide access to asset classes and investment expertise that often don’t exist within the traditional carriers themselves.

Indira Gopalakrishna, Milliman

Risk Management 360: A holistic approach to help low-income customers manage risks

Indira Gopalakrishna, Milliman